Credible Review

Last Updated: October 2023

- Fixed APRs starting at 4.43%⁰

- Helps students to find the best private loan rates

- Wide range of loan terms available

- Pre-qualification does not affect credit

- Back by an industry-leading Best Rate Guarantee

Overview

Furthering your education after you graduate from High School can be one of the most lucrative and beneficial choices you can make in life. But financing that endeavour isn’t always straightforward and easy, not to mention that it typically comes with years of strings attached. Those who take out student loans at the young age of 18 generally need to agree to less than favourable terms due to the fact that they lack much of a credit history and they don’t have steady employment, leading to higher interest rates and more money paid back over time.

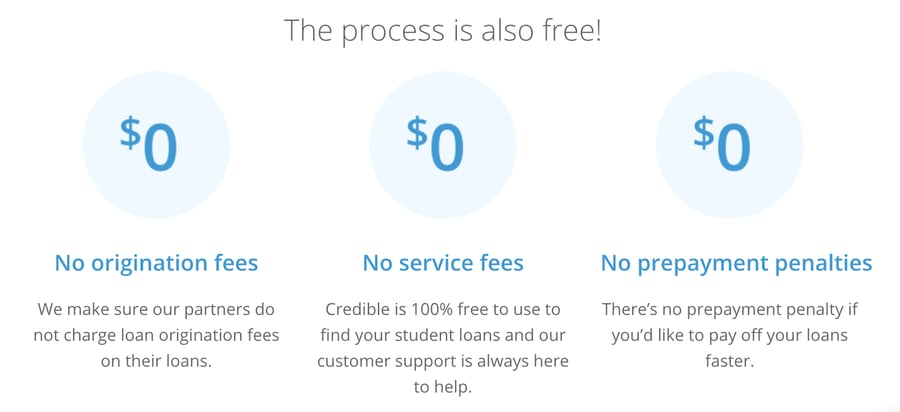

Thankfully, the terms and rates you agreed to when you were young don’t have to be the final terms you settle for once you have graduated and moved on in life. Companies such as Credible offer clients a simple way to reduce the amount of interest they pay over the term of their loans by allowing for loan refinancing. Through Credible, you can enjoy better terms, lower rates, and even compile multiple loans into one monthly payment, and their services are completely free. To find out more, read on through this Credible review and see exactly how refinancing works.

| PROS | CONS |

|---|---|

| Easily Compare Multiple Lenders Against Each Other | Limited to Lenders within the Credible Network |

| No Hard Credit Check Required for Pre-Qualification | |

| No Application or Origination Fees | |

| Single Streamlined Application Form | |

| Information is Kept Private & Only Shared with Selected Lenders | |

| Best Rates Guaranteed |

What is Loan Refinancing?

When taking out any type of loan there are many factors that go into how a lender decides what your interest rate and terms will be. The biggest factors in this decision are things such as your credit score and history, as well as your current financial situation and what your income is. Unfortunately for young students, they typically don’t have much in the way of a financial history and since they are pursuing their education they likely aren’t working full time and earning a large monthly income. Ultimately, this leads to pretty high interest rates that generate a lot of extra money owed on the loan.

But what happens after you graduate and have found a career you love, one that is earning you a great monthly income? Not to mention, you’ve probably spent the last 4 years building up a credit history, using a credit card, paying off bills, etc. Why should you still be paying the same interest rate on the same terms that you established back when you were younger?

Loan refinancing is a way of fixing this issue, and allows you to take out a new loan in order to pay off your existing one. By choosing a loan with a lower interest rate and better terms you can save yourself a significant amount of money month after month and in some cases even pay off your loan faster. In addition, refinancing is also a great way to relieve cosigners of their obligations, as you are able to apply for your new loan with or without a cosigner.

Finding the right lender for loan refinancing can be a bit tricky, however, which is why so many people turn to Credible for help. Their easy to use system allows you to fill out a free, no-obligation application to see if you pre-qualify and what your potential new rates would be. All of this is done online, and requires no hard credit check.

How Does Credible Work?

Credible is not an actual lender and when you use their services you aren’t applying for a loan through them specifically. Instead, Credible works as a lender marketplace and comparison platform, taking your information that you provide and showing you what other lenders would be willing to offer based on those facts. The benefit to using a comparison platform like Credible is that it utilizes a streamlined application process and is much faster than if you were to try and reach out to each lender individually.

As opposed to filling out separate applications for each lender you are curious about, Credible’s quick and easy single application form takes about 2 minutes to fill out and will connect you with the top lenders that are in their network. There is no hard credit check needed to see what you pre-qualify for, so it won’t impact your credit score nor will any of your private information be shared with the lenders.

After you submit your pre-qualification application you will then be shown an informative comparison chart where lenders are listed along with their potential APRs as well as how much you would pay each month. The numbers you are shown are not simply estimates like you would typically get when trying to do this yourself, and instead are actual rates that are based around your credit profile.

If there are refinancing options you are interested in, you can then proceed with your application and upload your loan details which takes approximately 3 minutes. From there, you will then be presented with a final offer which takes about 1 business day for you to receive. Final offers that are accepted will then need to be finalized through the specific lender you selected and this is done off of Credible’s platform.

What do You Need to Qualify?

When it comes to refinancing your loan the idea behind it is that you have built up your credit history, improved your credit score, and have landed yourself a well-paying job which factors into how interest rates are calculated. In order to be offered better terms than you originally agreed to, you need to be in a better financial position than you were before you started your degree, and if you aren’t, then loan refinancing probably isn’t the best choice for you. However, if you do feel you have accomplished a lot financially since you took out your student loan, you may be wondering what the exact criteria are that lenders are looking for.

The first requirements laid out in order to use Credible’s platform are as follows:

- You must be a US citizen or permanent resident

- You must have attended a recognized post-secondary institution

- You must have an active chequing account

Beyond that, there are other requirements laid out by each lender which will impact who is willing to work with you. Some may only work with students who owe significant amounts of money on their current loans, while others will have very high credit score requirements and income cut-offs. In order to know for sure if you qualify it is best to fill out a pre-qualification application, but some general rules are:

- Your loan must be a minimum of $5,000

- Your credit score should be over 670

- Some lenders may look at your debt to income ratio

Private Student Loans

Credible doesn’t just offer student loan refinancing, they also offer a platform for those who are seeking private student loans in order to finance their education. Like with refinancing, this isn’t an actual loan through Credible, but is a way to look at and compare a variety of lenders in order to find the terms and rates that best suit you.

Credible allows you to access pre-qualification from up to 8 lenders in only 2 minutes and is a quick and easy way to pursue what’s out there before committing to a specific lender. This is great for anyone who has already reached their federal loans limit and are still requiring additional financing. All rates that you will be provided with are real, not estimates, and you only need to fill out a single application in order to access this information.

Those who choose to use a cosigner on their application are 3x more likely to be approved, so this is worth considering before you apply. Many of the lenders allow for cosigner releases to be added into the contract, making it a worthwhile avenue to explore before committing.

As for the rates and terms you will be offered, this will be based on the specific lender you opt for. Both variable and fixed interest rates are available for you to choose from.

Personal Loans, Mortgages, & Credit Cards

Credible doesn’t just work with current students and graduates, however, and their financial comparison platform is home to a number of other resources for those who are seeking various types of loans and financial products. One of their popular options that they have is their personal loans which clients can access in order to make large purchases, consolidate their debt, finance home improvement projects, and more. In general, you can borrow up to $50,000 through certain lenders, although on Credible there are a few institutions who do approve loans to qualified borrowers for up to $100,000.

Those who are looking to buy a new home, or who already own a home and have an existing mortgage, will be happy to hear that Credible has financial opportunities available to assist you as well. Offering access to mortgages and mortgage refinancing lenders, Credible can help you finally make that big purchase, or save money on your existing home. Applying is the same process as with loan refinancing, and you simply need to fill out an application on their website and then browse through the lenders you pre-qualify with.

Finally, if you are in the market for a new credit card but are unsure which one is right for you, you can use Credible’s credit card comparison platform in order to see the benefits, rates, and terms of a variety of different cards. One of the standout features on the Credible credit card platform is that you can even sort the cards by type so that you are only shown certain options like ones that have cashback, cards that are secured, and even cards that are best for people who travel a lot.

Bottom Line

Whether you are looking to refinance an existing student loan, apply for a new one, buy a house, plan a wedding, or get a new credit card, Credible can help you make the right decision. Knowing what your options are and understanding what each lender is offering can lead to dramatic savings over time, as well as the ability to pay your debts off faster. Too many Americans jump on the first offer they receive simply because the process of applying for loans is so tedious and time-consuming, but with Credible that isn’t the case at all. Instead, their streamlined application form gives you more information and knowledge and only takes a few minutes in order to fill it out.

If you are being weighed down by the terms you agreed to when you were young then loan refinancing may be the right choice for you. To find out what you pre-qualify for, and to learn more about how it all works, check out Credible’s website today and learn how they are giving graduates more financial freedom through their simplified and helpful platform.

⁰ APR — Annual Percentage Rate checked and accurate for all partners as of October 24, 2023. Actual APR may change at any time without notice.

*Read rates and terms at Credible.com

Leave a review