Smart Financial Review

Last Updated: January 2024

- Compares top insurance providers quickly

- Online quotes available for most types of insurance

- Sorts & compares over 200 insurance providers

- Quote process takes only minutes to complete

- Access to additional educational resources

- 100% free for all services

Overview

There are a few key things in life that truly make you feel like you’ve reached peak adulthood. Moving out your parent’s house, getting a job in the career of your choosing, buying a vehicle or home, and obtaining insurance. While not the most thrilling item on the list, insurance is one of those necessities that people tend to put off until it’s too late, and while it may represent being a full-fledged adult, it also offers other important benefits that can help you protect yourself, your assets, and your finances long-term.

Life, home, and auto insurance are three of the most popular options that people decide to obtain in their lifetime, and there is good reason for that. Your home, your car, and your loved ones are likely the most important parts of your life, so you want to make sure you can take care of them no matter what. The downside to insurance, however, is that enrolling in a great plan takes a lot of time and effort – unless you choose SmartFinancial to help you take care of all your needs. Acting as a search engine and comparison site for all of your insurance needs, SmartFinancial makes it easy to get great insurance, at a great price. Read on through this SmartFinancial review to see how it works and why it is worth checking out.

| PROS | CONS |

|---|---|

| Completely Free to Use | |

| Free Quote Provided In Minutes | |

| Hassle-Free & Streamlined Form | |

| Great for Many Types of Insurance | |

| Provides Additional Education Resources |

Why Choose SmartFinancial?

Shopping around for anything takes time, especially when you are on the hunt for the best deal possible. Usually it means typing what you want into a search engine, and then browsing through the various stores until you find exactly what you’re looking for, at a price you are happy with. But when you go to shop around for something like insurance, the process becomes a bit more time-consuming and frustrating, because unlike new socks from Amazon, you can’t just click and add to cart when you find what you want.

Before you can purchase insurance you will need to fill out an application form, and depending on what type of insurance you are after and what company you want to work with, this application can be lengthy and require answers to very in-depth and personal questions. However, if you don’t feel like filling all of that out, then you can’t receive an estimated quote and thus you won’t know if you are actually getting the best deal possible.

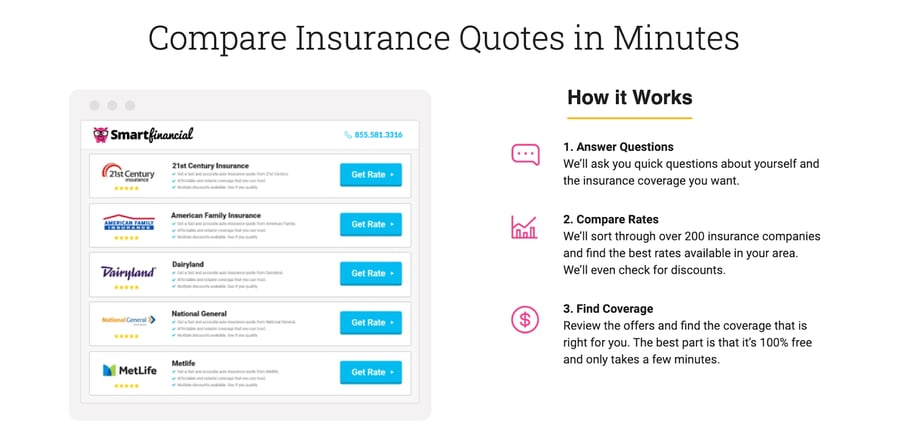

With SmartFinancial you get to skip those tedious quote applications and instead fill out one, quick application in order to see numerous quotes from a wide range of providers. An easy-to-understand comparison site, SmartFinancial will show you potential matches in your area, see if there are any current discounts available, and provide you with quotes so you can see who will give you the best coverage and fit into your monthly budget.

SmartFinancial’s services are free, you never have to put down a credit card number, and they are transparent and honest about what they offer. While they don’t personally provide you with insurance coverage through their website, they will connect you with potential providers and give you all of the resources and information you need to make an educated decision. To learn more about how SmartFinancial works, or to take advantage of their free educational resources and blogs, you can check out their website or give them a call directly to ask any questions you may have

How Does It Work?

You can think of SmartFinancial like Google for insurance. Just like with any search engine, you don’t need to pay to use it and you can simply click on what you are looking for and then proceed from there. SmartFinancial grants you access to a range of lenders and allows you to compare what they offer as well as their pricing all in one place.

Getting started is simple and all you need to do is visit their website, or call them directly, in order to answer some basic questions. You are able to search for a variety of different insurance types, and all you have to do is click on the type you are looking to obtain. From there, you will need to input your zip code, as some insurance providers are only available in certain states and pricing as well as special offers may be impacted by your location.

Since SmartFinancial doesn’t directly provide the insurance you aren’t required to fill out any lengthy applications or put down a significant amount of personal information. Instead, you will answer a handful of basic questions such as your age, your address, and then generalized questions about the types of insurance you want. This could include how much coverage you are seeking, whether or not you smoke, and whether you own or rent.

The questionnaire only takes a few moments to fill out and once you have completed it you will be taken to a screen where potential insurance providers are listed. The top listing will be the company that SmartFinancial thinks may suit your needs best, and the remaining providers are there for you to compare against. If you are interested in one of the insurance providers listed, you can then click on the link and you will be taken directly to their website where you can then complete the rest of the process with them.

Types of Insurance Offered

Not all insurance is created equally, and while it would be nice to have one policy that covers everything in your life, you likely are going to need to shop around for different policies from a variety of providers. Since your life insurance provider isn’t going to also be your auto insurance provider, it is important that you find the best deal possible for every type of insurance you end up deciding you need.

SmartFinancial makes it easy to browse not only a wide selection of companies, but also a wide selection of insurance types as well. Just bought a used car and need an extended warranty? SmartFinancial can put you in touch with auto insurance providers who can help you do just that. Finally bought your dream house and want to protect it in case of damages? SmartFinancial can pair you up with the perfect home insurance provider in your area.

Helping you to shop for all of your insurance policy needs, SmartFinancial specializes in comparing providers for:

- Auto Insurance

- Home Insurance

- Life Insurance

- Health Insurance

- Medicare Plans

- Commercial/Business Insurance

Financial Strength & Trustworthiness

If you’ve done your research beforehand then you’ve likely heard of financial strength when referring to insurance providers. This is an important thing to be aware of, as you want to make sure the provider has enough money to actually cover your payout should it ever come to that. In some cases, smaller and less financially secure providers may not end up having the funds on hand should something happen, in which case all the money you’ve been paying in premiums is for nothing and you are left without protection. Being aware of a company’s financial strength rating can help you to avoid these types of issues, and give you greater peace of mind and security knowing you are genuinely protected in case of problems.

With SmartFinancial there is no financial strength rating because they aren’t actually an insurance provider. Instead, their website simply helps you to view a range of providers quickly and easily so you can compare the results and then pick the provider you want to go with. The questionnaire you fill out via the SmartFinancial website isn’t an application, and the quotes you receive will be for external companies. Ultimately, the provider you end up selecting will be the one who provides you with your policy and whose financial strength you will want to check.

As for trustworthiness, SmartFinancial is extremely upfront and transparent about what they offer and what they don’t. Completely free to use, you aren’t required to give any credit card details or banking information, and the personal information you do give is very minor. In addition, all of the information you do provide within the questionnaire is completely confidential and is only used to narrow down your results so they are relevant to your personal situation and needs.

How Much Does SmartFinancial Cost?

SmartFinancial is completely free to use and there is no charge for any of their services. Just like any other search engine, all you are doing is looking up information that is relevant to you, and you will never need to give you credit card or banking information to do so. All of the quotes provided to you are simply estimates, and you can learn all about the various providers without paying a cent.

With that said, if you do decide to continue with the process and select an insurance provider to work with, you will be responsible for your monthly premiums through them. At that point, you will no longer be working with SmartFinancial at all, and instead will only deal directly with your insurance provider.

All of the quotes given on SmartFinancial are simply estimates based on the few questions you answered during the questionnaire. Actual rates may change once you fill out a real application on the providers website, and there is no guarantee that you will be approved. To learn more, or to speak with someone directly, you can contact a representative at SmartFinancial online or by phone and they will be able to answer any questions you may have.

Bottom Line

Getting insurance may feel like a huge headache that you don’t want to deal with, but the reality is that it can save you significant amounts of money, and heartache, down the road. While it may not be the quickest or easiest process, SmartFinancial does make it as hassle-free as possible and their website can save you hours of filling out applications or hunting around. With SmartFinancial you can quickly compare the various providers in your area and see who can offer you the best deal possible. Eliminating the need to fill out multiple applications, you can then simply work directly with that provider that best meets your needs.

To learn more about SmartFinancial, or to try out their comparison search engine for yourself, you can visit their website directly. SmartFinancial also offers you the ability to call them so you can speak with a knowledgeable representative who can answer any additional questions you may have.

Leave a review