Branch Review

Last Updated: October 2023

- Clients that switch save an average of $598

- Enter just your name and address for an instant price

- Bundle your insurance completely online! No agent needed

- We'll cancel your current policy for you

- Mobile app so everything you need is at your fingertips

- Claims are responded to quickly

Overview

Dealing with insurance providers may seem like a tedious, soul-crushing experience, and for most people this is their typical experience. From corporate policies to agents who are only looking out for the bottom dollar, trying to navigate the world of home or auto insurance can leave you feeling pretty disheartened and wishing there were alternatives that focused more on the people and less on the money.

Thankfully, the people behind Branch felt the exact same way, which is why they created an insurance company that is focused on actually helping people, the way insurance was originally intended to be. Quick, easy, and certainly painless, Branch makes getting coverage simple and their upfront and transparent policies means you are never left in the dark when it comes to filing claims and receiving assistance. No more inflated premiums or an inability to bundle and save, Branch rewards its customers and shows being protected doesn’t have to always come at a high cost.

| PROS | CONS |

|---|---|

| Enroll Quickly by Answering Only Two Simple Questions | ONLY Available in CO, OH, AZ, MO, IL, IN, & TX (Not Including Houston) |

| Bundles Auto & Home Insurance Together for Bigger Discounts and Savings | |

| Policies can be Customized for a more Personalized Experience | |

| Keeps Costs Low by Selling Direct-to-Consumer & Offering a Community Pledge Discount System | |

| Convenient Branch App Allows Account Access Anywhere, Anytime | |

| Backed by an A+ Financial Strength Rating |

Why Choose Branch?

It may seem like all insurance providers are the same, but with Branch there is actually good reason to get excited. Moving away from the typical structure that other companies offer, Branch has been dedicated to getting back to basics and taking its policies back to the days when insurance was a community-based security measure. Helping to keep one another safe and protected in case something happened, insurance was meant to help ease the unexpected, not drain your bank account and leave you stressed, and that is exactly what Branch is focused on doing today.

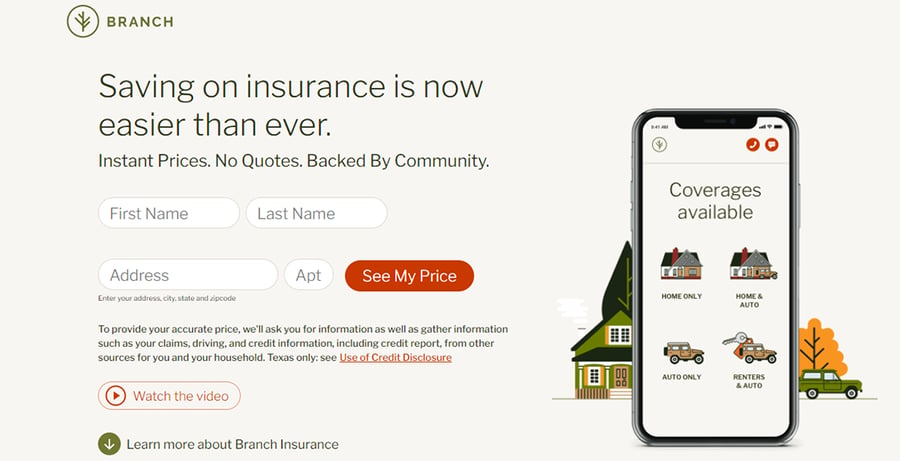

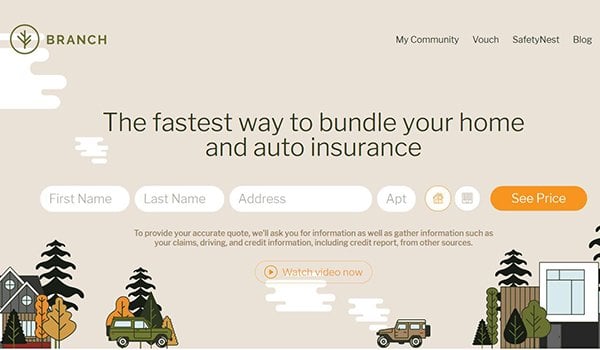

Offering instant prices, hassle-free claims, and the ability to bundle your home and auto insurance together, you can start saving money on your annual insurance premiums almost instantly just by visiting the Branch website. Faster than ever before, you can enjoy a real price within seconds by answering two simple questions, and you won’t be bombarded by phone calls or spam emails because of it. No drawn out quote processes here, Branch gives you real numbers, real fast, and from there you can customize and personalize a policy until it’s perfect for you.

Not only does Branch nail it when it comes to speed and efficiency, but they also have some of the best rates around, giving customers the chance to save money simply by switching. By selling directly to each client, Branch doesn’t incur the same costs that other providers do, and instead of simply pocketing these extra savings, they pass them on to you. Combined with their discounts for those who bundle their insurance, as well as a community-based discount program, it’s easy to see why Branch holds a 4.9 rating and is beloved by the clients who chose to make that switch.

How It Works?

Visiting any insurance providers website will take you to a free quote page where you can fill out a lengthy questionnaire and then submit it, only to then be forced to wait for someone to contact you to discuss everything in more detail. Tedious and time-consuming, quotes can sometimes be more hassle than they’re worth, which is why Branch has eliminated the quote process and instead gives you instant pricing within seconds.

Your journey with Branch begins with only two simple questions: what’s your name, and where do you live? From there you can then select if you’re interested in auto insurance, home insurance, or both, and Branch will give you an accurate number of what you would be expected to pay in premiums. Taking around 30 seconds from start to finish, you can end up fully covered and protected in virtually no time at all, and you can then review and checkout directly online.

One of the key things you will also be able to see when you check pricing on the Branch website is exactly how much you could potentially save by switching. Unlike other providers, Branch has made it their mission to keep costs low and they do this by eliminating unnecessary expenses such as creating costly advertisements. Instead, excess money is put back into the community so clients enjoy lower premiums, extra discounts, and bigger savings when they choose to bundle their insurance together.

Home & Auto Insurance Coverage

Branch offers insurance for both homes and vehicles, and customers have the option to bundle the two together to get better pricing and bigger discounts. Whether you’re a homeowner or renter, there are options available for you and they are able to cover both apartments as well as single-family residences. As for auto insurance, Branch is there to make sure every driver has adequate coverage and that every time you get behind the wheel you have the proper insurance to protect both you as well as other drivers on the road.

There is no one-size-fits-all policy at Branch, and instead you can customize your coverage based on your needs and preferences. Don’t have a car? That’s ok! You’re welcome to simply get home insurance or renter’s insurance without bundling. Not sure about deductibles or coverage amounts? You can always contact the team at Branch directly to get help with your policy.

Personalizing your policy online, however, is easy and Branch offers a number of different add-ons and customizable options so you can get coverage that is tailor-made for you. Do you use your car to drive for Uber or Lyft? That can come with its own set of risks and potential damage that standard auto insurance may not cover, but with Branch you can build that into your policy right away. Trying to pay the bills by renting out your condo on AirBnB? Branch can work with you to make sure your insurance policy protects you from rowdy house guests and messy nights.

Although you can enjoy both home and auto insurance separately, the ability to bundle them together is one of the reasons customers love Branch, since it helps to keep everything in one place and save you money at the same time. Highly recommended for anyone who has a car and rents or owns, it is worthwhile to explore the bundle options and see what kind of discounts you can enjoy.

Benefits of Bundling

Everyone wants to save money on their home and auto insurance and generally the only way to do that is to take a hit on how much coverage you have, or to increase your deductible to an outrageous amount. If neither of those options interest you though, Branch does make it easier than ever to save a significant amount annually simply by obtaining both your insurance policies through them.

Bundled policies have the potential to save some customers up to 20% overall on their insurance, depending on what they choose and what their history is like. That amount of savings not only means more money back in your pocket, but it can also mean that you are then able to add on extra coverage that you otherwise wouldn’t have been able to afford. Giving you better protection, comprehensive policies, and discounts you wouldn’t otherwise qualify for, bundling is great for both you and your wallet.

In addition to the opportunity to save yourself some money, choosing to bundle also makes it easier for you to keep track of your insurance and make sure you are up to date at all times with your provider. No one wants to have to try and track down their policy when they need it, opening up document after document in order to get the necessary information you’re looking for. Instead, Branch keeps both your auto and home insurance in one place and both can be quickly accessed using their smartphone app, giving you instant information no matter where you are.

Convenient and affordable, customers who choose to bundle their policies tend to find they are more satisfied than those who go with multiple providers, and that commitment and loyalty is oftentimes rewarded down the road with special discounts. If this interests you, and you would like to learn more about how bundling could benefit you personally, visit Branch’s website and see exactly how much you would pay when you bundle your home and auto insurance together.

Branch Pricing

Each and every policy is uniquely tailored to the person who is enrolling, which is why pricing is something that can’t be generalised. Instead of guessing and estimating how much you may or may not have to pay, Branch makes it easy to find out exactly what your cost will be, and the process takes only seconds to complete. When you visit their website all you need to do is click on “See My Price”, and you will be taken to a two-question form for you to fill out. From there, accurate pricing information will be displayed for you, and you can then compare it to your current rates to see if switching is worthwhile for you.

Genuinely committed to keeping costs more affordable, Branch does offer a number of ways to help save you money, including bundling your auto and home insurance, as well as by taking advantage of their Community Pledge program. Lowering your premiums by up to 5%, the Community Pledge program allows other Branch customers to vouch on your behalf that you won’t commit insurance fraud and that you are trustworthy and deserve a discount. Leveraging the power of a community, this program helps to weed out bad apples and continues to create a community that helps one another to save money year after year.

On average, those who have made the switch to Branch have saved around $598 annually compared to their previous provider, and the longer you stick with Branch, the more you can ultimately save. Using their stress-free switch option, Branch will handle all of the dirty work for you, so you can get instant coverage without having to worry about all of the back and forth that usually comes with cancelling and switching. Simple, affordable, and hassle-free, getting insurance through Branch is one of the best decisions you can make for long-term protection and enjoyment.

Bottom Line

Stop accepting costly insurance premiums and lackluster policies that only provide you with the bare minimum when it comes to coverage. You don’t need to be spending an arm and a leg every month only to then be left fighting for scraps when it actually comes time to make a claim and get that help you’ve been paying for. Instead, allow Branch to make insurance an easier and more worthwhile process, and see why switching your home and auto insurance over to them may be the best decision you ever make.

With customizable coverage and the ability to bundle your home and auto insurance together in one place, Branch is making insurance easier than ever before. Special discounts, community-based coverage, and transparent policies all combine together to make Branch one of the top insurance providers out there and an option that is definitely worth looking into. To learn more about Branch and the insurance policies they offer, visit their website today to see why they consistently are rated 5 out of 5 stars by their clients.

Leave a review