Earnest Review

Last Updated: February 2024

- APR starting at 4.65%⁰

- Provides customized private loan options for students

- Offers some of the most flexible terms available

- Online application includes an instant interest rate estimate

- Enjoy no early prepayment penalties*

Overview

Offering both private student loans and opportunities for refinancing, Earnest stands out for their competitive rates, lack of fees, and flexible term lengths that truly cater to the needs of students. With more transparency than your average lender, and an easy-to-utilize process that’s fully digital, this modern lender makes completing your studies simple and will bring that human touch and helping hand to ensure you make confident decisions about your future. Committed to changing how people borrow, Earnest delivers some of the lowest rates in the industry and you can enjoy a 50% longer grace period to help relieve some of that financial pressure long-term. Whether you’re in your first year, completing your Masters, or have successfully graduated and are hoping to refinance, Earnest can give you the funding you need with the flexibility you desire.

| PROS | CONS |

|---|---|

| Range of Options for both Private Student Loans & Refinancing | Not Available to Residents in KY or NV |

| Features Competitive Interest Rates & a Rate Match Guarantee | |

| Enjoy Flexible Terms & a 50% Longer Grace Period | |

| Welcomes the Use of Cosigners for Student Loans | |

| Allows Borrowers to Skip One Payment Each Year |

Types of Loans Offered

When Federal student loans don’t quite cover your schooling expenses, you may need to turn to private loans in order to make up the difference, and this is where Earnest steps up. Providing students with a range of loan options to choose from, Earnest looks at your entire situation and helps you to tap into personalized solutions that take into account your needs, your education, your finances, and your goals. More than just a standard lender, this compassionate company focuses on people, not numbers, and they work hard to strike a perfect balance between affordability and practicality. Putting you in control of your future, Earnest has flexible options available for a variety of educational purposes, and can assist with private funding that includes:

- Undergraduate Student Loans

- Graduate Student Loans

- Student Loans with Cosigner

- Parent Loans

- MBA Loans

- Medical School Loans

- Law School Loans

- Half-Time Student Loans

By ensuring you get the security you require, along with the support and guidance you deserve, Earnest has become a trusted lender that has helped over 208,000 clients complete their studies without worry. Through Earnest, you can simply focus on finishing your schooling, and every loan issued comes with a number of great benefits, including:

- A competitively low interest rate

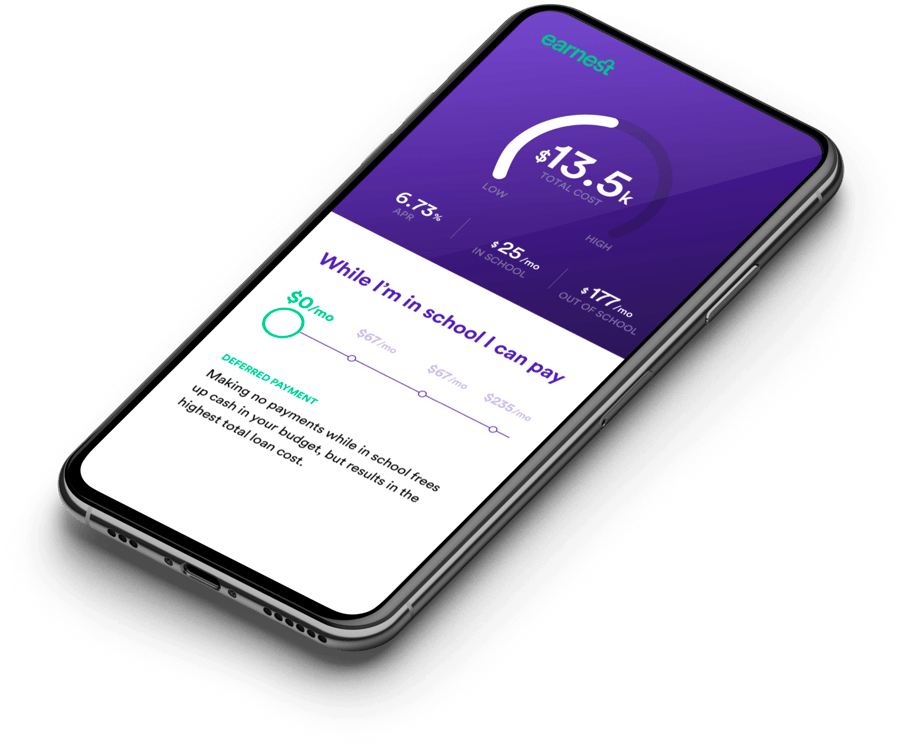

- The ability to pick your own payment and loan term

- The option to skip a payment each year

- A 50% longer grace period

- Potential enrollment in autopay for interest rate reduction

- No origination, late payments, or prepayments fees

- A Student Loan Origination Rate Match Guarantee

Beyond their flexible financing and rate match guarantees, Earnest also stands out from competitors with their people-first approach which can be seen throughout the entire loan process. Starting with their quick, easy, and fully digital application form, students don’t have to worry about complicated paperwork or lengthy delays and can explore their funding options in minutes right from their computer. If at any point during the application process, or even after you’ve received your funding, you have questions or concerns, Earnest has a compassionate Client Happiness team who is on hand to give you that extra clarity, comfort, and support. So, whether you’re just starting out your journey to higher education and are curious about private loans, or have years of experience under your belt and need that extra push to complete your goals, Earnest wants to be by your side and make funding your education simple, seamless, and worry-free.

Refinancing

For students who have already completed all of their studies and are now left with existing loans they are paying back, Earnest may be able to help you secure better rates or terms through their refinancing program. With refinancing, you can apply for a new loan through Earnest which is then used to pay off your old one, and ideally will leave you with a more competitive rate or flexible term that may cut years off of your original payment schedule. Although refinancing isn’t right for all situations, the best way to find out if it’s an option for you is to apply, and Earnest allows you to explore the possibility quickly and easily.

When you choose to refinance through Earnest you get to enjoy radical flexibility, and can choose your preferred payment amount and term length. You will also be able to remove an existing cosigner if it’s feasible, and in some cases have the ability to consolidate multiple loans into one streamlined monthly payment. Just like with Earnest’s student loan offerings, all of their refinancing loans include the same compassionate service and support they are known for, and you will be tapping into competitive rates that you’re unlikely to find elsewhere. In addition, Earnest is suitable for both federal and private loans and it only takes 2 short minutes to check your eligibility and potential rate. All of this can be completed directly on the Earnest website, where you can browse through all of their educational resources and connect with the Client Happiness team who would love to answer any questions you might have regarding refinancing.

Eligibility Requirements

Earnest prides themselves on being the place students can turn when they need assistance with funding their educational journey, and in order to remain open and accessible they have clearly laid out all of their eligibility requirements for full transparency. Each loan type that they have available will come with it’s own unique criteria that you need to meet in order to be eligible, however, all applicants will need to:

- Be a US citizen or posses a 10-year Permanent Resident Card

- Reside in DC or 1 of 48 states (not including KY or NV)

- Be the age of majority in the state you reside

- Have a minimum FICO score of 650-700 (depending on loan type)

Beyond the bare minimum requirements, Earnest also lays out exactly what is required for each specific private student loan type directly on their website. This includes the requirements for Parent Loans, Undergraduate or Graduate Loans, and Cosigned Loans. You can also complete the free application form online to see immediately whether or not you are approved, and if so, what your personalized rate offer would be.

If you are hoping to refinance, the requirements are a bit different and Earnest’s eligibility breakdown does cover both Student Loan Refinancing and Parent Plus Refinancing. In regards to refinancing, eligibility requirements will also include having a steady income, student loan accounts that are in good standing, being in good standing with rent or mortgage payments, and having no bankruptcies listed on your credit report. Like with student loans, the best way to know for sure whether or not you’re eligible would be to complete the online application where you can receive a real decision quickly.

Earnest Cost

Applying for student loans through Earnest is not only simple and straightforward, it’s also completely free, and there is no application fee or approval fee that you will encounter when doing so. In fact, Earnest is known for not charging many fees at all, and they have even eliminated common charges like origination fees, prepayment fees, or late fees. Instead, you get to enjoy radically flexible funding that is tailored to your needs, as well as on-going support and guidance from a compassionate team that always keeps their clients at the forefront. To help make your educational journey a smooth one, Earnest forgoes costly fees in favor of potential discounts, and if you’re hoping to save money every month you can enroll in autopay for a 0.25% rate reduction. Earnest also goes above and beyond to help make your repayment experience more affordable by giving you a 50% longer grace period and the opportunity to skip one monthly payment without penalty each year.

Bottom Line

Featuring some of the most competitive rates on the market for both private student loans and refinancing, Earnest is here to help you fund your education and they want to make it a simple, seamless, and affordable experience so you can focus on your studies without worrying about costs. Through their flexible terms, rate match guarantee, and truly tailored approach, this modern lender goes beyond just looking at numbers and instead focuses on creating realistic solutions for the students who put their trust in them. If you’ve found yourself requiring a bit of extra funding for the upcoming school year, or you’re currently paying off loans and aren’t fully satisfied with the rate or term you have, then now is the time to connect with Earnest to see how they can build you a customized solution that meets your needs. Apply today using the simple, online application and see why so many students trust Earnest to help them accomplish their educational goals.

⁰ APR — Annual Percentage Rate checked and accurate for all partners as of January 29, 2024. Actual APR may change at any time without notice.

Leave a review